Less than a month ago on February 19, 2025, the S&P 500 hit an all-time closing high of 6,144.15. At the intraday lows earlier this week, the world’s most widely watched equity benchmark was down more than 600 points from that peak, a correction of more than 10.4%.

Technology and growth stocks have been underperforming since last summer; however, relative trends have deteriorated even more so far this year, and the Nasdaq 100 now sits some 13.4% off its highs from just last month.

(Queue the scary “market in crisis” headlines in the mainstream media.)

As I wrote in my most recent updates, “A Classic Growth Scare” on March 2nd and “Economic Jitters, Adding Duration,” released two days later on March 4th, I believe the main issue roiling markets right now is fear of an economic soft patch or recession.

In my view, it remains too early to determine if we’ll see a recession this year or if this is just, yet another, growth scare coupled with a healthy pullback in equity markets after two years of heady gains. However, as I’ve outlined in recent updates, the economic and market trends I’m seeing are powerful and dangerous enough to persist for some time.

The end result:

I expect a bumpy volatile ride for stocks at least through the middle of this year and an underlying bid for bonds.

That’s true even if we avoid recession and only experience a temporary economic slowdown or “soft patch.”

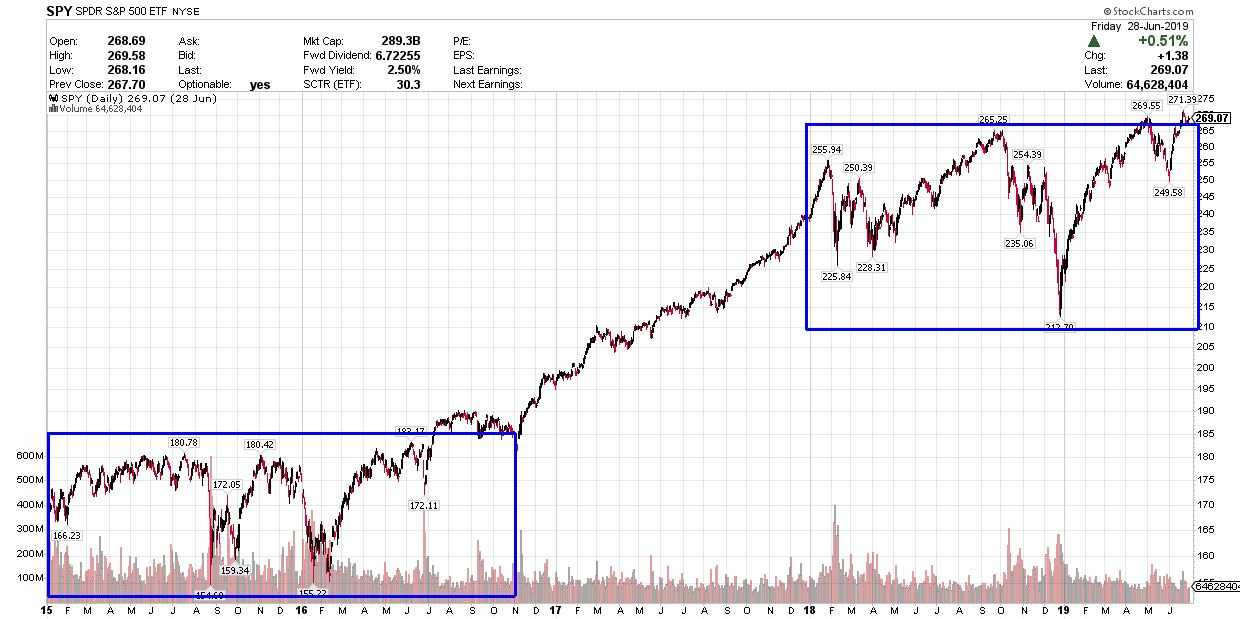

Take a look at the S&P 500 in 2015-2016 and again in 2018 as an analog:

Source: Chart Courtesy of Stockcharts.com

The US economy avoided recession in both 2015-16 and 2018 though growth slowed and the Fed was forced to change plans to hike rates on both occasions.

However, look at the boxed regions of my chart – in both growth scares the S&P 500 remained in a volatile trading range with no upside progress for a period of 18 to 24 months.

The good news is that most of our recommendations in Smart Bonds are benefiting from the economic and stock market woes that have plagued most investors in recent days.

Through the first 11 weeks of 2025 the Baseline model portfolio is up 1.39%, the Defensive Portfolio has returned 0.82% and the Dynamic 60/40 Portfolio, which allocates funds to both Smart Bonds recommendations and the S&P 500, is down just 2.1% despite the 7.3% plunge in the S&P 500 over a similar holding period.

However, as luck would have it, the explosion in stock and bond market volatility since the middle of February coincides with the timing of our normally scheduled quarterly update issue of Smart Bonds.

As long-time readers know, I seek to limit portfolio turnover in Smart Bonds as my primary mission in this service is to accumulate income (monthly distributions from ETFs), and capital gains, to generate wealth with limited volatility over the long haul.

Further, remember the classic Wall Street adage:

“There are old traders and there are bold traders, but there are no old, bold traders.”

I believe a similar sentiment applies to long-term investors, which is why my approach to portfolio management favors gradual adjustments over dramatic shifts based on incoming news. Bold portfolio moves in response to ever-changing popular investment and political narratives can all-too-often lead to painful whipsaws and ill-timed sales.

After all, just consider how many times over the past three years alone the prevailing market narrative has flip-flopped from imminent recession to inflationary boom and higher-for-longer rates.

Regardless, there are times when market conditions merit increased activity and right now is one of those times. Indeed, as I’ve explained in recent updates, I believe we’re approaching a critical phase of the economic cycle where bond, credit and fixed income securities, the very markets we track using ETFs in Smart Bonds, stand to see the strongest gains of the entire cycle.

There are also dangers, particularly for those who overstay their welcome in more vulnerable, economy-sensitive segments of these markets or get too aggressive buying duration (rate sensitivity) too early in the cycle.

With those points in mind, I recommended some changes to portfolio positioning last week to maximize our potential upside while mitigating downside risks. I’m making two new portfolio recommendations in a longer issue to be released this afternoon.

I believe it’s far more important to introduce these portfolio shifts in real-time, and in response to changing market signals and trends, rather than to produce our normal lengthy quarterly update report with a hefty focus on our 30,000-foot view of markets.

Action and speed must take precedence over lengthy written analysis and portfolio reviews at times like these.

So, this month I’ll be releasing the normal quarterly issue in stages rather than as a single report.

I’m starting with the most urgent and time-sensitive information – new portfolio additions and changes to existing recommendations and portfolio weights. Later this month, I’ll release a more detailed rundown of all existing portfolio recommendations, some market and economic scenarios and risks I’m planning for and my “big picture” strategy for approaching markets through the remainder of this year.

I believe you’ll find my (slightly) altered approach and publication schedule for this quarter more closely aligned with our goal of protecting and growing wealth through the current opportunity-rich phase of the market cycle for our coverage universe.

In this brief alert, however, I wished to start out by reviewing the portfolio shifts I recommended last week with a detailed breakdown of the math behind changes to the portfolio allocations. The same basic process for portfolio changes will apply to the recommendations I’ll be releasing a little later today.

Let’s start with the Baseline Portfolio:

Keep reading with a 7-day free trial

Subscribe to Smart Bonds to keep reading this post and get 7 days of free access to the full post archives.